How To File A Sworn Denial For Debt Law Suits

- Defending Yourself In Court Against Debt Collector

- How To File A Sworn Denial For Debt Law Suits 2017

.This is not a substitute for a lawyer’s representation. Try to talk to or hire a lawyer before answering a lawsuit.You can also use our online interview,.

It creates the necessary court forms. Use it instead of this packet if you do not want to handwrite your forms. Should I answer the Complaint?Yes, if you want to defend the lawsuit. If you do not file an Answer, the court will enter a Default Judgment against you.

Do I have to answer the Complaint?No, but if you do not file an Answer, the court will enter a Default Judgment against you. What if I do not answer the Complaint?The plaintiff will win automatically. Plaintiff will get a judgment for everything they asked for in the complaint. I offered to make small payments on my bill OR told Plaintiff I would make full payments as soon as possible.

Can Plaintiff sue me anyway?Yes. They will file a lawsuit. If they win, the court will add the costs of that suit to what you owe. The creditor does not have to accept anything less than what you owe.

I cannot afford to pay the debt. Can they sue me anyway?Yes. That is not a defense. What is a Declaration of Exempt Income and Assets?A declaration is a sworn statement. The Declaration of Exempt Income and Assets lets your creditors know you have income and/or assets the law says they may not take from you.

If you think your income is protected or exempt from garnishment, you must still respond, but you should also consult a lawyer.If you know for sure your income and/or assets are protected or exempt from garnishment, you should also file a Declaration of Exempt Income and Assets and serve the Plaintiff’s lawyer. See What are a Summons and Complaint?The person starting a lawsuit must prepare a written statement telling the judge what the problem is and what they want. That statement is the Complaint.The person starting the lawsuit is the Plaintiff.If the lawsuit is against you, you are the Defendant.

If the lawsuit names you as a Defendant, you must respond, even if you think the debt is not yours!The lawsuit might be against you and JOHN DOE or JANE DOE. Plaintiff is trying to sue both you and your spouse. Plaintiff believes you are married but does not know your spouse’s name. If you are married and the complaint names your spouse (their actual name or JOHN or JANE DOE), you must both respond to the Complaint.Plaintiff must have a copy of the Complaint delivered to you so you will know about the lawsuit.In the Complaint, Plaintiff makes statements about you and about debts that Plaintiff believes you owe. The Plaintiff saying things about you in the complaint does not make them true.

An Answer is your chance to tell the court which of Plaintiff’s statements are true and should be admitted, which are not true and should be denied, and which statements you do not know or understand, or cannot remember if it is true (should be denied for lack of information).You will also get a Summons. It says:.You have a right to disagree with the Complaint in writing.How long you have to answer the Complaint. You have 20 days from the date the Complaint is handed to you or someone in your home, NOT 20 days from the date stamped on the Summons and Complaint.Where to deliver your Answer.A Summons is NOT a notice of a court hearing date. It gives instructions about how to respond to the complaint.If you do not tell the court in writing that you disagree with the statements in the Complaint, the judge will assume you agree with it and will often give Plaintiff what Plaintiff asked for. Plaintiff wins by default if you have not answered. If the court enters a Default Judgment against you, you will not get notice of the Judgment if you have not at least filed a Notice of Appearance.Once Plaintiff gets a judgment against you, Plaintiff may be able to take money from your bank account or paycheck, or take some of your property to pay the judgment.You must file a written response within the time limit in your Summons.

It is usually twenty days from the date a server hands the papers to you or someone in your home. Read the Summons carefully for the deadline.You may respond by delivering to the person who signed the Summons and Complaint one of these:. a Notice of Appearance. an AnswerA Notice of Appearance states you are appearing in the lawsuit. Delivering a Notice of Appearance will stop the court from entering a default judgment against you without a hearing. A Notice of Appearance does not explain your position in the lawsuit. Your Answer does this.Try to do both the Notice of Appearance and Answer at the same time.

You must at least do the Notice of Appearance. If you have it delivered and filed before Plaintiff goes to court, Plaintiff must notify you of all future court hearings.Use our Answer form. The directions for filling it out are below or use our. It will help you fill it out. What is an Answer?It is your written response to the statements in the Complaint.

You are the defendant.In your Answer,.State if you admit, deny, or lack knowledge of each statement made by Plaintiff. Do not admit any statement unless you know it is 100% true. Do not guess! If you do not know if the account number listed is your credit card number or if the amount Plaintiff says you owe is correct, deny the statement. If you do not understand what Plaintiff is saying, say you lack knowledge.Type or neatly print your answer.

Your Answer must be clear and readable.By filing an Answer in time, you keep your rights to argue about this matter in court and to get notice of future hearings.You may feel embarrassed or guilty about being in debt. You may just want it all to be over. You should still file an Answer. It does not mean you are trying to avoid your debts. You may disagree with the amount Plaintiff asked for in the Complaint. You may want to preserve your right to get notice of future hearings. If you do not file an Answer, you may lose your chance to say how much you think you should pay.If you file an Answer and lose the court case, you may owe Plaintiff more court costs and attorney fees.You will need one original and two copies of your Answer.

You file the original with the court. One copy goes to Plaintiff. You keep a copy. The section below, 'What to do with the Answer,' explains. How do I fill out the Answer and Affirmative Defenses?A.

COURT, STATE OF WASHINGTON COUNTY(YOUR OPPONENT’S NAME),No. Plaintiff,vs.ANSWER AND AFFIRMATIVE DEFENSES(YOUR NAME),Defendant.The top line gives the court, the state, and county names. Examples: 'District Court, State of Washington, Pierce County;' 'In the Superior Court of the State of Washington in and for the County of Pierce.' .The left side lists Plaintiff and Defendant’s names. It might list your name and then say JANE DOE or JOHN DOE.

If you are married, the creditor is suing both you and your spouse. The creditor puts JANE DOE or JOHN DOE if the creditor does not know if you are married or does not have your spouse’s actual name.When both you and your spouse are sued (your spouse’s actual name is listed or the Complaint says JOHN DOE or JANE DOE), you both must respond to the lawsuit. You both must sign and date the Notice of Appearance and Answer.The right side lists the number the court clerk assigned this case and the pleading’s title.Starting July 28, 2019, the Summons and Complaint must have a case number. If you are served before then with an action that does not have a case number, talk to a lawyer right away. You are still bound by the time limit in the Summons but you might not have to file your Answer with the court yet.When you fill out your Answer, fill out the caption at the top of the page. Copy the needed info from your Summons and Complaint.

Copy Plaintiff’s and Defendant’s names just as they are on the Summons and Complaint, even if they spelled your name wrong or called you or your spouse 'John Doe.' Admissions/Denials/Lack KnowledgeUse the middle of the page to give your answers to the statements in the Complaint. Usually, the Complaint’s paragraphs are numbered. You should list the numbers and say one of three things about each paragraph of the complaint:.You admit it is a true statement. ( Examples: you live in Pierce County.

You are not a member of the Armed Forces.) Admit the statement only if you agree with every part of it. Otherwise, deny it.You deny it is a true statement. ( Example: You owe a specific amount of money to the person named.) Do not assume you owe a certain amount! Do not guess!.You lack knowledge. You do not know if the statement is true. ( Example 1: The collection agency suing you claims it is licensed and bonded. You might assume they are, but you have no evidence.

You have never seen their license.) ( Example 2: Plaintiff uses words like venue, jurisdiction, or assignment. You do not know what these mean.) Do not guess!Read the Complaint carefully. You must answer all the Complaint’s statements by putting a number next to Admit, Deny, or Lacks Knowledge.C. DefensesYou may have technical or legal defenses to the Complaint. The Answer in this packet lists possible defenses.

Some examples:.The statute of limitations has run. Actions to collect debts have a time limit.

We call it the 'statute of limitations.' It usually starts once the creditor has a right to sue you ( example: once you miss a payment). Once the time limit has passed, the creditor can no longer collect from you.Insufficient service of process. You did not get the Summons and Complaint the way the law requires. The Summons and Complaint should be handed to you or to someone of suitable age living with you.Eligible for Charity Care. The claim is for a hospital bill.

The bill should have been paid for by DSHS or should have been covered by Charity Care.For more on defenses you may have, call CLEAR if you have a low income (1-888-201-1014, Monday– Friday 9:15 a.m. – 12:15 p.m). Do you have forms I can fill out on a computer?Yes. You can use our online interview to create the necessary court formsORThe following forms are available for you to download in MS Word format:.I have filled out the documents (Notice of Appearance and/or Answer). Now what?.Sign and date each form.Make two copies of each form – one for Plaintiff (or Plaintiff’s attorney, if there is one) and one for yourself.Hand deliver or mail ( do not fax) one copy of each form to Plaintiff or Plaintiff’s attorney, if there is one. You can do this yourself.

You do not need someone else to do it.If you deliver the forms in person, Plaintiff’s attorney must get them by the deadline (20 days from the date the Summons and Complaint were handed to you or a member of your household). Ask the attorney or office staff to date-stamp your copy.If you mail the documents, you must put them in the mail at least three (3) days before the deadline. Ask the Post Office for tracking and delivery confirmation.Fill out the Certificate of Service:Fill out its caption.

Put the date you are mailing or hand-delivering the documents to Plaintiff or Plaintiff’s attorney.List which documents you are mailing or hand-delivering. ( Example: Notice of Appearance, Answer)List Plaintiff’s attorney’s name and address.At the bottom, put the date and place (City and State) where you filled out the Certificate of Service. Sign the Certificate. Make one copy for your records.Take all the original documents (the ones you signed) to the Clerk of the Court and file them. Have your copies date-stamped to prove they were filed.Keep your copies.You must file your Answer within the time limit listed in your Summons (usually twenty days). Once you have timely filed your Answer and served Plaintiff's lawyer, you should get notice of any hearings. If you have already missed your time limit, file an answer anyway.

A late Answer may be better than none at all. If you are too late, and the court has entered a judgment against you, talk to a lawyer right away.

Defending Yourself In Court Against Debt Collector

This post is the second in a series of post. In the first post, we discussed the debt buying business.

If you have not yet read through that post, you might find it informative.Regardless if it is the original company you owed, or one of the debt buyers discussed in the first post, eventually you might be sued on the debt. Following is a discussion of how these suits are often prosecuted against you.The first indication you will have that you are being sued will likely be a sheriff or private process server knocking on the door with a “Summons”. In this document will be the name of the company who is suing you, the date set for the court hearing, and details on the basis for the suit. You may not even recognize the company who is suing you. That may be because the debt has been purchased by another company.

Do not think it will not affect you.When you examine the papers, you likely will see the phrase “sworn account”. A suit bought on sworn account is a common practice in the debt collection practice but what does it mean?When a creditor sues claiming you owe money, they must provide proof to the court that it is actually you that owes money and the amount you owe. If they can prove this, and you can’t or don’t refute the evidence, the court will find in their favor and they will get a judgment against you. With this judgment they can garnish wages, seize bank accounts, etc.How does a creditor prove their case? One way is for the creditor to provide a copy of the original document you signed obligating yourself on the debt, such as the original credit card application.

With that and billing statements, the creditor can establish that you owe them money. For many creditor’s this is difficult or impossible to do as they no longer have the original application or billing statements. This is particularly true if the suit is prosecuted by a debt buyer.In Tennessee, we have a law, found at Tennessee Code 24-5-107.

This law allows creditors another option. They simply provide a sworn statement that says the creditor is owed money by you and if you do not deny their sworn statement, they are not required to provide any additional proof to obtain their judgment.You have options should you be served with a suit on sworn account.

How To File A Sworn Denial For Debt Law Suits 2017

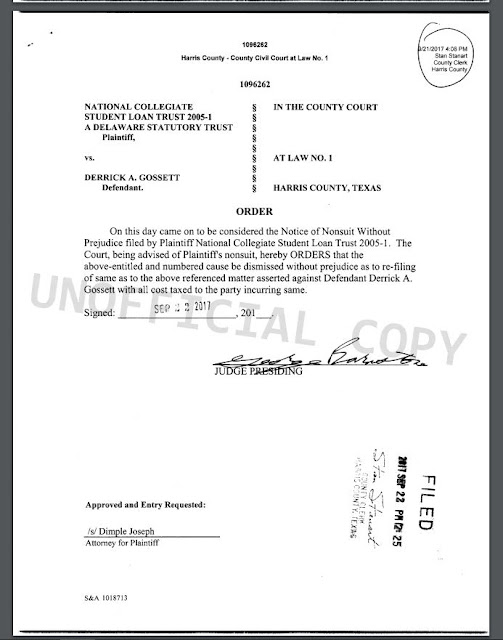

First, you can show up in court and deny that you owe the company. You can also visit the clerk’s office and file a sworn denial. If you do either of these, the company suing you will be required to provide proof such as the promissory note and/or statements. If you are not sure you owe the debt you are being sued for, you should do this.In a follow up post on statute of limitations defenses, we’ll discuss another common way to avoid the judgment.Of course, you may recognize the debt, understand you owe the debt, and the creditor is entitled to their money. There are ways to deal with the judgment which we’ll discuss in subsequent post.Depending on the amount of the suit, and your other debt, you might benefit from filing bankruptcy.

At Nashville bankruptcy lawyers Long, Burnett, and Johnson, PLLC, we are happy to meet with you to evaluate your situation. There is no cost for an initial office consultation so call us today if you would like to learn of ways to deal with a suit on sworn account. You can set up an appointment by calling (615)386-0075.Filed Under: Tagged With:,.